The MoU will enable joint experimentation with regard to CBDCs and facilitate other digital innovation initiatives between the central banks.

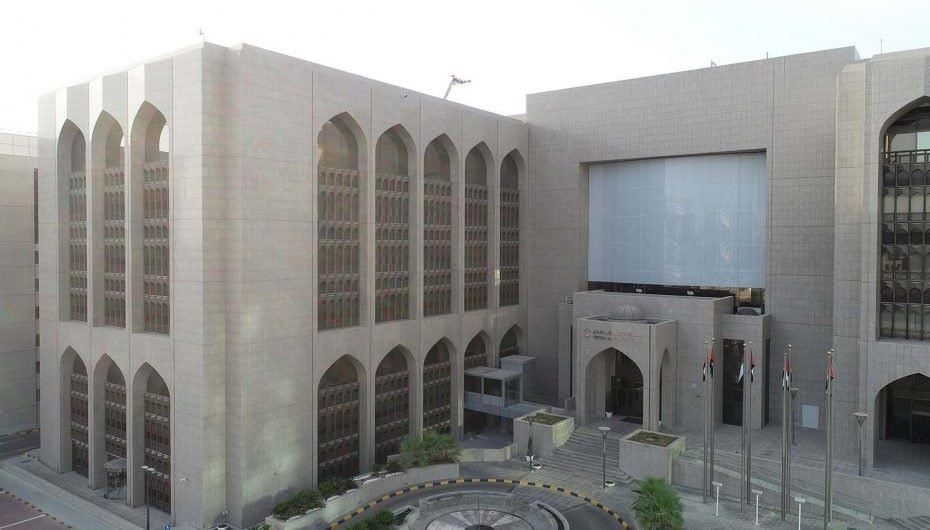

The central banks of the UAE and India have signed a memorandum of understanding (MoU) in Abu Dhabi on March 15.

The Central bank of the UAE and Reserve Bank of India will collaborate on various emerging areas of fintech especially Central Bank Digital Currencies (CBDCs) and explore interoperability between the CBDCs of CBUAE and RBI, reported the state news agency, WAM.

CBUAE and RBI will jointly conduct proof-of-concept (PoC) and pilot(s) of a bilateral CBDC bridge to facilitate cross-border CBDC transactions of remittances and trade.

Central banks to share knowledge on fintech

The MoU also includes technical collaboration and knowledge sharing on matters related to fintech and financial products and services, such as emerging trends, regulations and policies.

The agreement is expected to enable joint experimentation with regard to CBDCs and facilitate other digital innovation initiatives between the central banks.

This bilateral engagement between the central banks will witness the testing of cross-border use cases involving CBDCs, which is expected to reduce costs, increase the efficiency of cross-border transactions, and further economic ties between India and the UAE.

Other developments

In recent news, the CBUAE released figures revealing that the total investments of banks operating in the country reached Dhs528bn at the end of December 2022.

This represents an 11.5 per cent annual increase or Dhs54.5bn compared to the same period in the previous year, when the total investments were Dhs473.2bn.

Saving deposits in the UAE banking system, excluding interbank deposits, increased to Dhs246.61bn at the end of November last year.

This represents a growth of approximately Dhs7.21bn, or 3 per cent, from about Dhs239.4bn in November 2021, as per statistics shared by the Central Bank of the UAE (CBUAE).

In January, CBUAE also issued new guidelines on anti-money laundering and combatting the financing of terrorism (AML/CFT) for licensed financial institutions (LFIs), including banks, finance companies, exchange houses and insurance companies, agents and brokers.

The guidelines focus on the use of digital ID mechanisms that LFIs should employ to perform customer due diligence obligations (CDD) on an ongoing basis. The latest guidelines, which come into effect immediately, require LFIs to comply with the central bank’s requirements.

The guidelines specifically discuss identity proofing, enrollment, and authentication mechanisms in relation to LFIs’ use of digital ID systems. LFIs are required to use technology best practices, adequate governance and well-defined policies and procedures.

Source: Central banks of UAE, India boost collaboration with MoU (gulfbusiness.com)

Recent Comments